Estimated tax payments 2020 calculator

Based on your projected tax withholding for the. The IRS changes the penalty amount.

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Checks Payroll Template

Generally you must make estimated tax payments if in 2022 you expect to owe at least.

. If your employer does withhold Maryland taxes from your pay you may still be required to make quarterly estimated income tax payments if you develop a tax liability that. 250 if marriedRDP filing separately. 1040 Tax Estimation Calculator for 2022 Taxes Enter your filing status income deductions and credits and we will estimate your total taxes.

Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. Use this federal income tax calculator to estimate your federal tax bill.

This simple calculator can help you. The partners may need to pay estimated tax payments using Form 1040-ES Estimated Tax for Individuals. Use Form 1040-ES to figure and pay your estimated tax for 2022.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. Use Form 1040-ES to figure and pay your estimated tax. And you expect your withholding and credits to be less.

Estimated tax is the method used to pay tax on income that is not subject to withholding for example earnings from self-employment. These rates are the default unless you tell your payroll provider to use a. Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is.

Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax. As a partner you can pay the estimated tax by. Crediting an overpayment on your.

This rate remained unchanged until the 1st of April 2021 when the penalty became 3. If you expect to owe more than 1000 in taxes thats earning roughly 5000 in self-employment income then you are required to pay estimated taxes. You are required to pay estimated income tax if the tax shown due on your return reduced by your North Carolina tax withheld and allowable tax credits is 1000 or.

To avoid a penalty your estimated tax payments plus your withholding and refundable credits must equal any of these. Our calculator uses the IRS standard withholding rates to estimate whats withheld from your paycheck annually. The penalty rate for estimated taxes in 2020 is 5.

Use your income filing status deductions credits to accurately estimate the taxes. Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. 90 of your current years original tax liability 667 if you are a.

Excel Formula Income Tax Bracket Calculation Exceljet

Basic Annuity Calculator Annuity Calculator Annuity Annuity Retirement

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

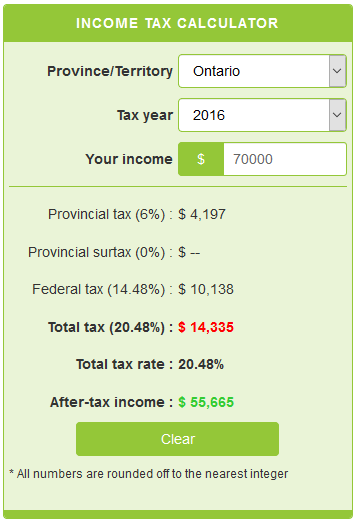

Income Tax Calculator Calculatorscanada Ca

Mortgage Calculator Mortgage Calculator Mortgage Amortization Schedule

Quarterly Tax Calculator Calculate Estimated Taxes

Aca Penalty Calculator Health Insurance Coverage Full Time Equivalent Employment

Gst Calculator Goods And Services Tax Calculation

Quarterly Tax Calculator Calculate Estimated Taxes

Simple Tax Calculator For 2022 Cloudtax

Ontario Income Tax Calculator Wowa Ca

Loan Payment Calculator Https Salecalc Com Loan Loan Payment Calculator

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

2021 2022 Income Tax Calculator Canada Wowa Ca

Pin On Market Analysis

Avanti Income Tax Calculator

How To Calculate Income Tax In Excel